Hi I'm GS1 Bot and i can answer some common questions about....

Industry

Services & Support

GS1 Supporting Services

Get Compliant & Supply & Chain Efficient

Solutions

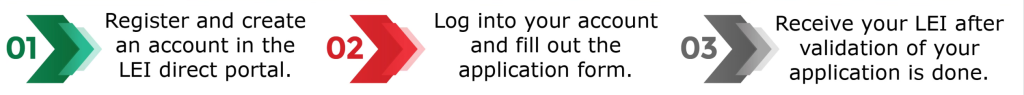

Legal Entity Identifier

Partner & Solutions

Event & Media

News & Articles

Events

- Calendar of Events

- Post-Event Report

- Archive

Gallery

- Photos

- Press Release